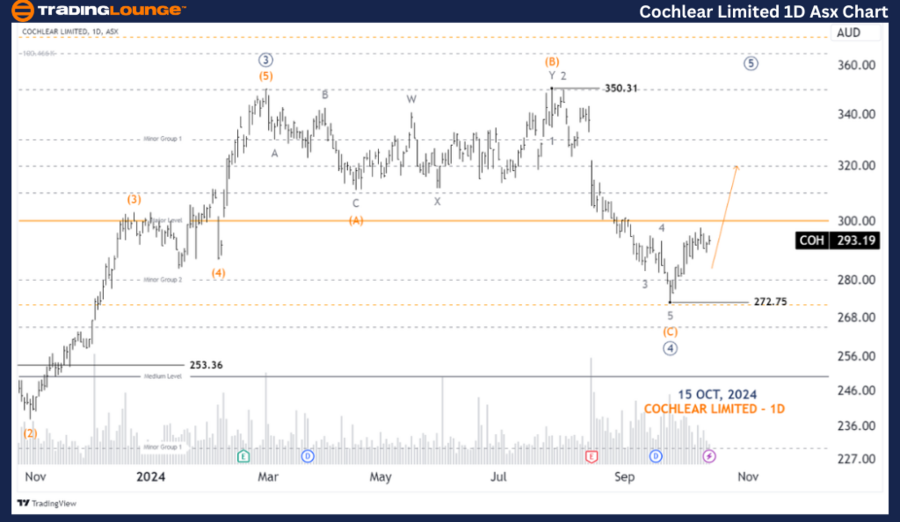

ASX: COCHLEAR LIMITED – COH Elliott Wave Analysis (1D Chart)

Greetings! Today's Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) with an update on COCHLEAR LIMITED (COH). Based on the current wave pattern, COH is expected to advance further with the development of a ((5))-navy wave.

ASX: COCHLEAR LIMITED - COH 1D Chart (Semilog Scale) Analysis

COH Elliott Wave Technical Analysis

Function: Major trend (Primary degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((5))-navy

Details: Wave ((4))-navy has ended, and wave ((5))-navy is in progress, indicating further upward movement. A Long Trade Setup will be confirmed if the 300.00 price level holds as support after a retest. Further insights into wave ((5))-navy will be explored on the 4-hour chart.

Invalidation Point: 272.75

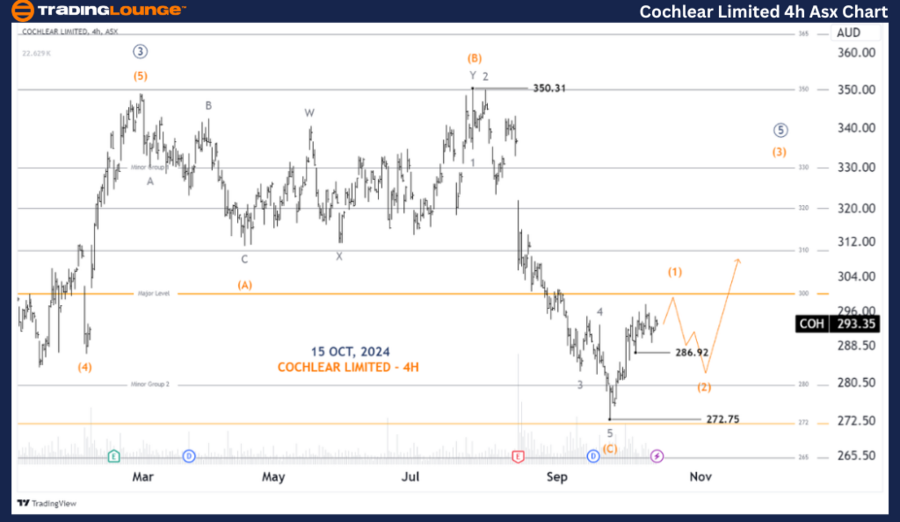

ASX: COCHLEAR LIMITED - COH 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (1)-orange of Wave ((5))-navy

Details: Following the low at 272.75, wave (1)-orange has shown substantial upward movement. However, after reaching a high point, wave (2)-orange is expected to retrace lower before wave (3)-orange resumes the upward trend, continuing the bullish trajectory.

The bullish outlook remains valid as long as the price stays above 286.92. If the price drops below this level, it suggests that wave (2)-orange is in progress.

Invalidation Point: 272.75

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: GOODMAN GROUP (GMG) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: COCHLEAR LIMITED (COH) provides a clear framework to monitor current trends and develop trading strategies. We emphasize specific validation and invalidation price points to enhance confidence in our wave counts and forecasted movements. By combining detailed chart analysis with precise entry points, we strive to offer a professional, objective perspective to help readers make informed decisions in the market.