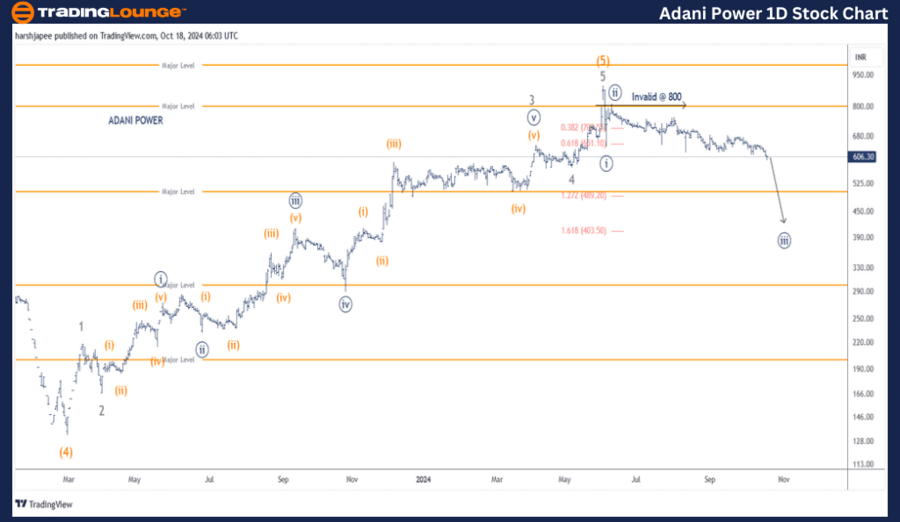

ADANI POWER Elliott Wave Analysis TradingLounge 1D Chart

ADANI POWER 1 Day Chart Analysis

Adani Power Elliott Wave Technical Analysis

Function: Counter Trend (Intermediate degree, orange)

Mode: Corrective

Structure: Potential Impulse within Larger Degree Zigzag

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) Navy is moving lower within Minor Wave 1, targeting levels below 800. A confirmed break under 580 could push the price towards the 490-500 zone.

Invalidation point: 800

ADANI Power Daily Chart Technical Analysis and Elliott Wave Count Overview:

The daily chart for ADANI Power indicates the stock may have completed a bullish progression near the 900 level, coinciding with the termination of a fifth wave at multiple degrees. If accurate, a corrective drop at the Minor degree is expected to unfold below the 900 resistance.

Intermediate Wave (4) Orange was likely completed around 130 in February 2023. Since then, Minor Waves 1 to 5 appear to have finished, potentially marking the end of Intermediate Wave (5) Orange near the 900 range. The extension in Minor Wave 3 followed expectations.

If this analysis holds, ADANI Power should ideally remain under the 900 level, and more precisely below 800, maintaining the counter trend bias. The stock is projected to continue falling, with Minute Wave ((iii)) likely heading towards at least the 500 region.

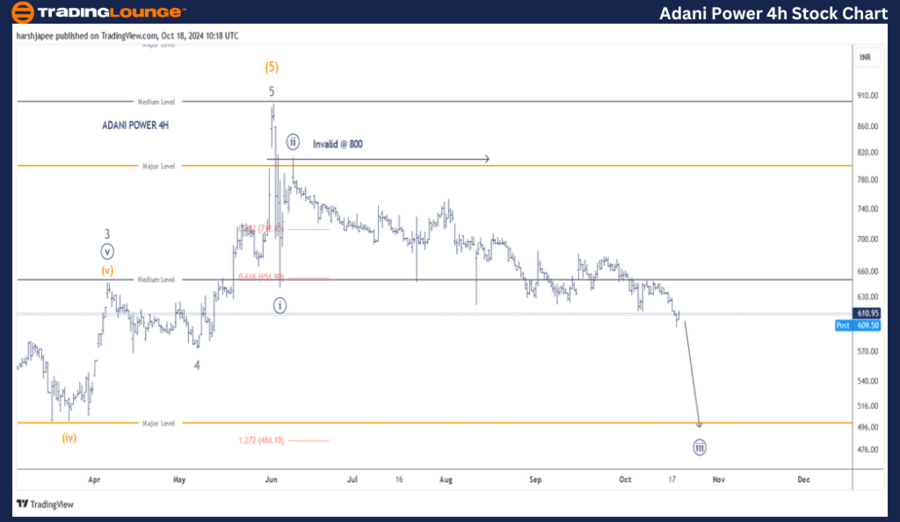

ADANI POWER Elliott Wave Technical Analysis (4H Chart)

ADANI POWER Elliott Wave Analysis

Function: Counter Trend (Intermediate degree, orange)

Mode: Corrective

Structure: Potential Impulse within Larger Degree Zigzag

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) Navy is currently declining within Minor Wave 1, against resistance at 800. If the stock breaks below 580, it could accelerate toward the 490-500 area. Alternatively, the stock might see a temporary bounce from 580, forming Minor Wave 4, before continuing higher.

Invalidation point: 800

ADANI Power 4H Chart Technical Analysis and Elliott Wave Count Overview:

The 4H chart for ADANI Power shows a major high formed near the 900 level. The stock is now in the midst of a larger corrective wave, with Minute Waves ((i)) and ((ii)) completing around 645 and 800, respectively. Minute Wave ((iii)) appears to be in progress, potentially pushing the price lower towards 500.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: TITAN Company Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

ADANI Power may have reversed from its highs at 900 and is now advancing within Minute Wave ((iii)) Navy, with a target around the 500 level in the upcoming sessions.