ASX: CSL LIMITED – Elliott Wave Analysis & Forecast | TradingLounge

Greetings, Traders!

Today's Elliott Wave analysis delivers the latest insights on CSL LIMITED (ASX: CSL), a key stock on the Australian Stock Exchange (ASX).

A significant bullish wave expansion appears to be developing in the third wave of ASX: CSL. This analysis identifies potential trend reversals and key price levels that could confirm when the bullish trend strengthens.

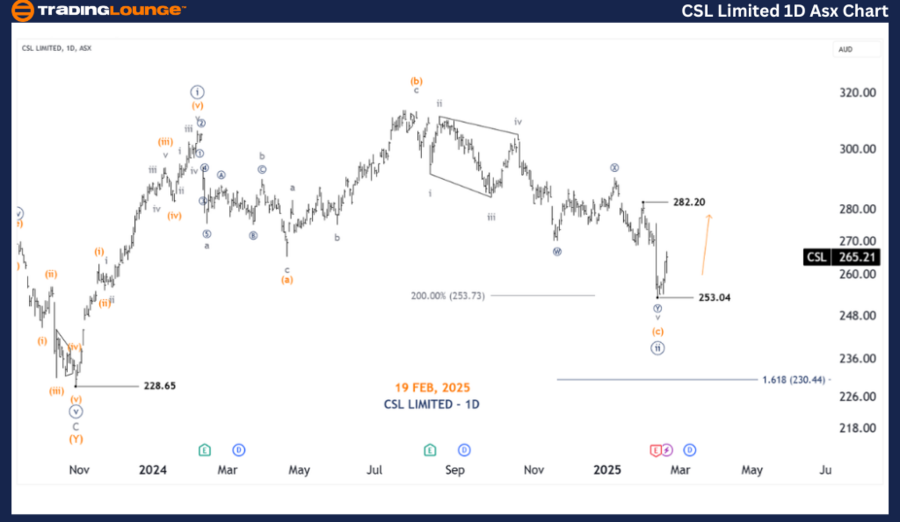

ASX: CSL LIMITED – Elliott Wave Technical Analysis (1D Chart – Semilog Scale)

Market Function: Major Trend (Minute Degree, Navy)

- Wave Mode: Motive

- Wave Structure: Impulse

- Current Position: Wave ((iii)) - Navy

Key Analysis Details:

- Wave ((ii)) - Navy appears to be forming a Flat correction (a)(b)(c) - Orange, signaling a possible completion.

- Wave ((iii)) - Navy must break above 282.20 to confirm the bullish outlook.

- Invalidation Point: 282.20

- Confirmation Point: 282.20

ASX: CSL LIMITED – Elliott Wave Technical Analysis (4-Hour Chart) | TradingLounge

Market Function: Major Trend (Minute Degree, Navy)

- Wave Mode: Motive

- Wave Structure: Impulse

- Current Position: Wave ((iii)) - Navy

Key Analysis Details:

- The ((ii)) - Navy wave found support at 253.04.

- A new ((iii)) - Navy wave could be emerging from this level.

- Breakout Level: A break above 282.20 would validate the bullish trend and indicate strong upside potential.

- Invalidation Point: 253.04

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave forecast on ASX: CSL LIMITED (CSL) presents a detailed trend outlook, highlighting key price levels and potential entry points for traders.

By providing specific validation and invalidation signals, we enhance confidence in our wave count. This technical analysis combines critical price action levels with an objective market forecast to guide traders in making informed decisions.