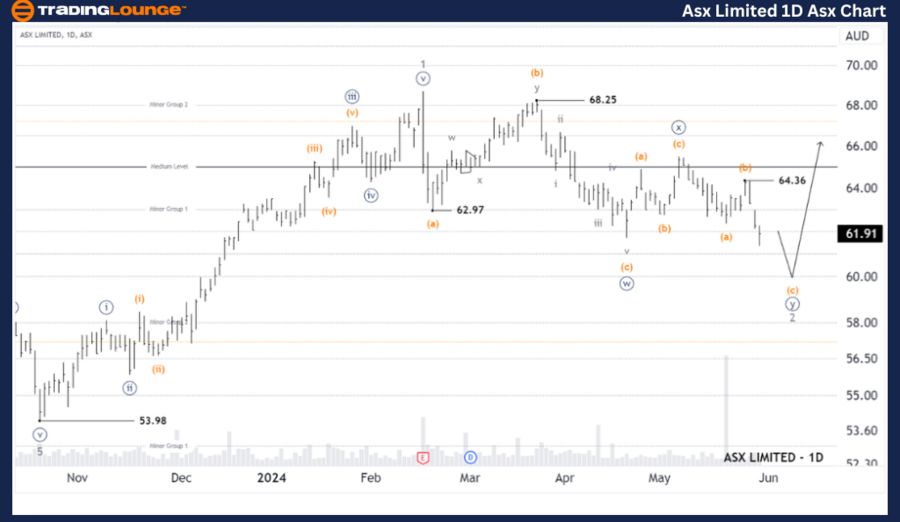

ASX: ASX LIMITED - ASX Elliott Wave Analysis TradingLounge (1D Chart)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with ASX LIMITED - ASX. We see that the ASX has extended its correction wave more than expected. So ASX is developing under the Double Zigzag pattern and looks like it will soon complete wave 2-grey. Following that, wave 3-grey is ready to return to push even higher.

ASX: ASX LIMITED - ASX Elliott Wave Technical Analysis

ASX: ASX LIMITED - ASX 1D Chart (Semilog Scale) Analysis

Function: Major (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave (c)-orange of Wave ((y))-navy of Wave 2-grey

Details: The short-term outlook indicates that wave 2-grey is extending longer than expected and continues to develop as a Double Zigzag. Wave ((x))-navy has recently completed, and now wave ((y))-navy will push lower. After that, wave 3-grey can resume to push higher.

Invalidation point: 64.36

ASX: ASX LIMITED - ASX Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

ASX: ASX LIMITED - ASX Elliott Wave Technical Analysis

ASX: ASX LIMITED - ASX 4-Hour Chart Analysis

Function: Counter trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (c)-orange of Wave ((y))-navy

Details: The shorter-term outlook indicates that wave 2-grey is unfolding as a Double Zigzag with a high level of detail. Wave ((x))-navy has recently completed, and wave ((y))-navy appears to be unfolding and is nearing completion. The second leg of the Zigzag pattern is finishing, so it may continue to push slightly lower, seeking support around 61.18 - 59.23. Following this, wave 3-grey is expected to resume and push higher.

Invalidation point: 64.36

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: V300AEQ ETF Units – VAS Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: ASX LMITED - ASX aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.